Embark on a journey through the US Residential Mortgage Market Outlook 2026, delving into rate forecasts, lender comparisons, credit score impacts, and housing scenarios. This comprehensive overview promises to provide valuable insights into the future landscape of the market.

Explore the intricate details and key components of this dynamic market, shaping the way for informed decisions and strategic planning.

Overview of the US Residential Mortgage Market

The US residential mortgage market has a long history dating back to the early 20th century when the Federal Housing Administration (FHA) was established to provide more accessible home loans. Over the years, the market has evolved with the introduction of government-sponsored entities like Fannie Mae and Freddie Mac, which play a significant role in shaping mortgage lending practices.

Currently, the US residential mortgage market is one of the largest in the world, with trillions of dollars in outstanding mortgage debt. Key players in the market include banks, credit unions, mortgage lenders, and government agencies. These entities provide a wide range of mortgage products to help individuals finance their home purchases.

The market's significance cannot be understated, as it serves as a crucial driver of economic activity. A healthy residential mortgage market supports the construction industry, boosts consumer spending, and contributes to overall economic growth. Moreover, fluctuations in the mortgage market can have far-reaching effects on the broader economy, making it a closely monitored sector by policymakers and economists.

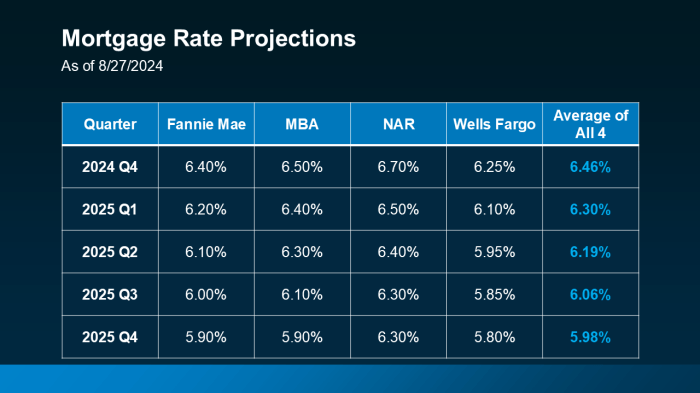

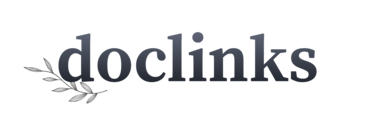

Rate Forecasts in the US Residential Mortgage Market

When looking at the trends in mortgage interest rates over the past few years, we can see a pattern of fluctuation influenced by various economic factors. These fluctuations can impact the affordability of housing for potential buyers and the profitability of investments for lenders.

Factors Influencing Mortgage Rate Forecasts for 2026

As we look ahead to 2026, several key factors will play a role in shaping mortgage rate forecasts:

- The Federal Reserve's monetary policy decisions, including potential interest rate hikes or cuts.

- Economic growth projections and inflation rates that may impact the overall market conditions.

- The housing market trends, such as supply and demand dynamics, and the impact of new construction on inventory levels.

- The global economic landscape and geopolitical events that could influence the stability of financial markets.

Potential Impact of Economic Indicators on Future Rate Changes

Economic indicators provide valuable insights into the health of the economy and can signal potential changes in mortgage rates:

- Unemployment rates: Lower unemployment rates may lead to higher consumer spending and inflation, potentially pushing mortgage rates up.

- GDP growth: Strong economic growth can also lead to higher mortgage rates as demand for loans increases.

- Inflation rates: Rising inflation can erode the purchasing power of the dollar, prompting lenders to raise rates to offset inflation risks.

- Consumer sentiment: Positive consumer sentiment can drive demand for homes and loans, influencing mortgage rates accordingly.

Lender Comparison in the US Residential Mortgage Market

When it comes to choosing a mortgage lender in the US residential mortgage market, borrowers have a variety of options to consider. Each type of lender comes with its own set of advantages and considerations, so it's important to understand the differences between them before making a decision.

Major Lenders in the US Residential Mortgage Market

- Banks: Traditional banks are one of the most common types of mortgage lenders. They offer a wide range of mortgage products and often have physical branches for in-person assistance.

- Credit Unions: Credit unions are member-owned financial institutions that may offer more personalized service and lower fees than traditional banks.

- Online Lenders: Online lenders operate entirely over the internet, providing convenience and often faster application processes. They may also offer competitive rates.

Comparison of Different Types of Mortgage Lenders

- Interest Rates: Banks and credit unions may offer more competitive rates for borrowers with established relationships, while online lenders may have lower overhead costs and pass on the savings in the form of lower rates.

- Customer Service: Credit unions are known for their personalized service, while online lenders may provide quick responses and easy communication through online platforms.

- Application Process: Online lenders typically have streamlined, digital application processes, while banks and credit unions may offer in-person assistance for a more hands-on experience.

Key Criteria for Choosing a Mortgage Lender

- Interest Rates: Compare rates from multiple lenders to ensure you're getting the best deal.

- Fees: Consider all fees associated with the loan, including origination fees, closing costs, and prepayment penalties.

- Customer Service: Evaluate the level of customer service provided by each lender, including responsiveness and support throughout the loan process.

- Loan Options: Look for a lender that offers a variety of loan products to meet your specific needs.

Credit Score Impact on the US Residential Mortgage Market

In the US residential mortgage market, credit scores play a crucial role in determining mortgage eligibility and interest rates. Lenders use credit scores to assess the risk of lending money to potential borrowers. A higher credit score indicates a lower risk for the lender, leading to better mortgage terms for the borrower.

Importance of Credit Scores

Credit scores are a key factor that lenders consider when evaluating mortgage applications. A good credit score demonstrates financial responsibility and the ability to manage debt, making you a more attractive borrower. On the other hand, a low credit score may result in higher interest rates or even rejection of your mortgage application.

- Lenders typically categorize credit scores into ranges, such as excellent (above 750), good (700-749), fair (650-699), poor (600-649), and bad (below 600).

- Borrowers with excellent credit scores are more likely to qualify for lower interest rates and better mortgage terms.

- On the contrary, borrowers with lower credit scores may face challenges in securing a mortgage or may have to settle for higher interest rates.

Tips for Improving Credit Scores

Improving your credit score can help you qualify for better mortgage terms. Here are some tips to boost your credit score:

- Pay your bills on time to establish a positive payment history.

- Keep your credit card balances low and avoid maxing out your credit limits.

- Avoid opening multiple new credit accounts within a short period, as it can negatively impact your score.

- Regularly review your credit report and dispute any errors that could be dragging down your score.

- Work on paying off existing debts to reduce your overall debt-to-income ratio.

Housing Scenarios in the US Residential Mortgage Market

When it comes to the US residential mortgage market, housing scenarios play a crucial role in shaping the dynamics of the industry. Let's delve into various scenarios that can impact home price trends, inventory levels, and demand-supply dynamics, and analyze their implications on mortgage borrowers and lenders.

Impact of Home Price Trends

Home price trends have a direct impact on the affordability of homes for potential buyers. Rising prices can make it challenging for first-time buyers to enter the market, while falling prices may lead to issues for existing homeowners looking to sell.

Lenders need to adjust their mortgage offerings based on these trends to remain competitive in the market.

Inventory Levels and Demand-Supply Dynamics

The balance between housing inventory levels and demand-supply dynamics is crucial for a healthy housing market. Low inventory levels coupled with high demand can drive up prices, making it harder for buyers to find affordable options. On the other hand, oversupply can lead to a decrease in prices, affecting both sellers and lenders.

Implications for Mortgage Borrowers and Lenders

Fluctuations in the housing market can have significant implications for both mortgage borrowers and lenders. For borrowers, changes in home prices and inventory levels can affect their ability to secure financing and determine the affordability of their monthly mortgage payments.

Lenders, on the other hand, need to adapt their lending criteria and interest rates based on these scenarios to manage risk effectively.

Ending Remarks

In conclusion, the US Residential Mortgage Market Outlook 2026 offers a multifaceted view of what lies ahead, equipping stakeholders with the knowledge needed to navigate through the changing landscape with confidence and foresight.

Detailed FAQs

What factors influence mortgage rate forecasts for 2026?

Mortgage rate forecasts for 2026 are influenced by various factors such as economic conditions, inflation rates, and government policies.

How do different credit score ranges affect mortgage eligibility and interest rates?

Different credit score ranges can significantly impact mortgage eligibility and interest rates. Higher credit scores generally lead to better terms and lower interest rates.

What are the potential implications of housing market fluctuations on mortgage borrowers and lenders?

Housing market fluctuations can affect mortgage borrowers and lenders by impacting property values, demand for mortgages, and overall market stability.

![Top 10 SEO Companies In Houston [2025] | Aero Business Solutions](https://market.doclinks.org/wp-content/uploads/2025/12/SEO-Company-in-Houston-120x86.jpg)