Wealth Management Fees Explained: US Market Leaders vs Boutique Firms (2026 Guide) sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

The guide explores the intricacies of wealth management fees in the US market, comparing the approaches of industry giants and boutique firms, shedding light on key factors that influence fees, and emphasizing the importance of transparency in fee structures.

Introduction to Wealth Management Fees

Wealth management fees play a crucial role in the realm of financial planning, as they directly impact the returns and costs associated with managing one's assets. These fees are charged by financial advisors or firms for the services they provide in managing clients' investments, offering financial advice, and creating personalized strategies to meet specific financial goals.

Typical Fee Structures in the US Market

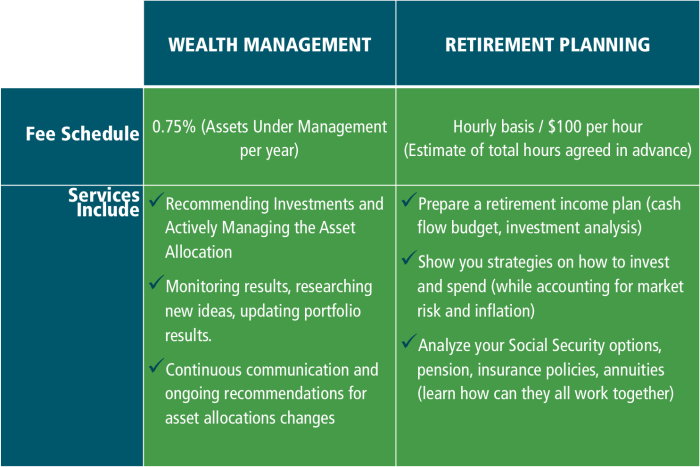

In the US market, wealth management fees are commonly structured in two main ways: as a percentage of assets under management (AUM) or as a flat fee based on the services provided. Percentage-based fees typically range from 0.5% to 2% of AUM, depending on the size of the portfolio and the level of service offered.

On the other hand, flat fees are fixed amounts charged annually or quarterly, regardless of the portfolio size.

Comparison of Fee Structures: US Market Leaders vs Boutique Firms

- US Market Leaders:

- Market leaders often charge higher percentage-based fees due to their brand reputation, extensive resources, and access to top-notch financial experts.

- These firms may also offer a tiered fee structure, where the percentage decreases as the AUM increases, providing some cost savings for larger portfolios.

- Additional services such as tax planning, estate planning, and risk management are typically included in the overall fee.

- Boutique Firms:

- Boutique firms, on the other hand, may charge lower percentage-based fees to attract clients and compete with larger firms.

- These firms often provide a more personalized approach to wealth management, catering to the unique needs and preferences of individual clients.

- Flat fees are also common among boutique firms, offering transparency and predictability in pricing for clients.

US Market Leaders in Wealth Management

When it comes to wealth management in the United States, there are several market leaders that stand out for their reputation, services, and client base. These firms have established themselves as top players in the industry, offering a wide range of services to meet the diverse needs of their clients.

Top US Market Leaders

- 1. Morgan Stanley Wealth Management: With a long history and a global presence, Morgan Stanley is known for its comprehensive wealth management services, including investment management, financial planning, and estate planning.

- 2. Merrill Lynch Wealth Management: As a subsidiary of Bank of America, Merrill Lynch offers a broad range of financial services, including investment management, retirement planning, and wealth transfer strategies.

- 3. UBS Wealth Management: UBS is a global financial services firm that provides wealth management services to high-net-worth individuals and institutional clients, offering investment solutions and financial planning services.

Services Offered by Market Leaders

These top US market leaders in wealth management offer a wide array of services to cater to the needs of their clients. Some of the services typically provided include:

- Investment management

- Financial planning

- Estate planning

- Retirement planning

- Tax planning

Fee Structures and Client Impact

The fee structures of these market leaders vary, typically based on the level of assets under management and the complexity of services provided. Clients may be charged a percentage of assets under management, flat fees, or a combination of both.

These fees can impact clients in terms of cost, transparency, and overall value received. It's important for clients to understand the fee structures of these market leaders to make informed decisions about their wealth management needs.

Boutique Firms in Wealth Management

When we talk about boutique firms in the realm of wealth management, we are referring to smaller, specialized firms that offer personalized financial services to a select group of clients. These firms often pride themselves on providing tailored advice and a high level of client service.

Advantages of Working with Boutique Firms

Working with boutique firms can offer several advantages over larger institutions:

- Personalized Service: Boutique firms typically have fewer clients, allowing for more personalized attention and customized financial strategies tailored to individual needs.

- Specialized Expertise: These firms often specialize in niche areas of wealth management, bringing in-depth knowledge and expertise to the table.

- Direct Access: Clients may have direct access to senior advisors and decision-makers within boutique firms, fostering a closer relationship and more transparent communication.

- Focused Approach: Boutique firms are known for their focused approach, concentrating on a specific client base and delivering specialized solutions.

Fee Structures of Boutique Firms vs US Market Leaders

When it comes to fee structures, boutique firms and US market leaders may differ in their approach:

| Aspect | Boutique Firms | US Market Leaders |

|---|---|---|

| Fee Flexibility | Boutique firms may offer more flexibility in fee structures, allowing for negotiation based on the services provided and the client's needs. | US market leaders often have standardized fee schedules that may be less negotiable. |

| Transparency | Boutique firms tend to be more transparent about their fee structures, ensuring clients understand what they are paying for and why. | US market leaders may sometimes have complex fee structures that are less transparent to clients. |

| Cost | Boutique firms may have lower overhead costs, which can translate to potentially lower fees for clients. | US market leaders, with their larger scale and resources, may have higher fees to cover operational expenses. |

Factors Influencing Wealth Management Fees

When it comes to wealth management fees, several factors come into play that can influence the amount clients are charged. These factors include the size of assets under management, the complexity of the client's financial needs, and the level of service provided by the wealth management firm.

Assets Under Management

The size of a client's portfolio is a significant factor in determining wealth management fees. Typically, wealth management firms charge a percentage of the assets under management as their fee. As the value of the assets increases, the fee charged by the firm also tends to increase.

This is because managing a larger portfolio may require more resources and expertise from the firm.

Complexity of Financial Needs

Clients with more complex financial needs, such as tax planning, estate planning, or investment management across multiple asset classes, may incur higher fees from wealth management firms. The complexity of the client's financial situation often requires additional time, expertise, and resources from the firm, leading to higher fees to cover these services.

Level of Service

The level of service provided by a wealth management firm can also impact the fees charged to clients. Firms that offer personalized financial planning, regular portfolio reviews, access to specialized investment opportunities, and dedicated financial advisors may charge higher fees compared to firms that provide a more basic level of service.

Clients willing to pay for a higher level of service can expect to incur higher fees.

Negotiating Fees

Clients can often negotiate wealth management fees with firms, especially if they have a substantial amount of assets to be managed. By discussing their specific needs, comparing fee structures with other firms, and being willing to walk away if necessary, clients may be able to negotiate lower fees or more favorable terms with wealth management firms.

Justification of Fee Structures

Wealth management firms typically justify their fee structures by highlighting the value they provide to clients. This value may include personalized financial planning, investment expertise, access to exclusive investment opportunities, and ongoing monitoring and adjustments to the client's portfolio. Firms often emphasize the long-term benefits of their services in helping clients achieve their financial goals as a way to justify their fee structures.

Transparency and Disclosure in Wealth Management Fees

Transparency and disclosure in wealth management fees are crucial for clients to make informed decisions and understand the true cost of managing their wealth. By having clear information about fees, clients can evaluate the value they are receiving and ensure that their financial goals align with the services provided.

Regulations and Guidelines for Fee Disclosure

In the wealth management industry, regulations and guidelines govern how firms disclose their fees to clients. For example, the Securities and Exchange Commission (SEC) requires registered investment advisors to provide clients with a Form ADV, which details the advisor's fee structure, potential conflicts of interest, and other important information.

Additionally, the Department of Labor's fiduciary rule requires financial advisors to act in the best interest of their clients when providing retirement advice, including fee disclosures.

Best Practices for Clients

- Review Fee Agreements: Clients should carefully review fee agreements with their wealth managers to understand the types of fees they will be charged, including management fees, performance fees, and any other related costs.

- Ask Questions: Clients should not hesitate to ask their wealth managers about any fees they do not understand or need clarification on. It is important to have open communication to ensure full transparency.

- Compare Fees: Clients can compare the fees charged by different wealth management firms to ensure they are getting a competitive rate for the services provided. It is essential to consider both the cost and the value of the services offered.

- Regular Fee Reviews: Clients should request regular fee reviews with their wealth managers to assess the fees being charged and determine if any adjustments need to be made based on changes in financial circumstances or investment performance.

Conclusive Thoughts

In conclusion, understanding the nuances of wealth management fees is crucial for making informed financial decisions. Whether opting for the services of US market leaders or boutique firms, clients can navigate the landscape more effectively armed with the knowledge gained from this guide.

Top FAQs

What factors influence wealth management fees?

Factors such as assets under management, complexity of financial needs, and level of service can impact wealth management fees.

How can clients negotiate fees with wealth management firms?

Clients can negotiate fees by discussing their specific needs, comparing fee structures from different firms, and emphasizing the value they seek.

Why is transparency important in wealth management fees?

Transparency ensures clients are fully aware of the fees they are paying and helps build trust between clients and wealth management firms.

![Top 10 SEO Companies In Houston [2025] | Aero Business Solutions](https://market.doclinks.org/wp-content/uploads/2025/12/SEO-Company-in-Houston-120x86.jpg)