Best High-Yield Savings Accounts in the United States (2026 APY Rates, Minimum Balance Rules & FDIC-Insured Options) sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve deeper into the intricacies of high-yield savings accounts, we uncover a world where financial growth and security converge to provide account holders with optimal benefits.

Overview of High-Yield Savings Accounts

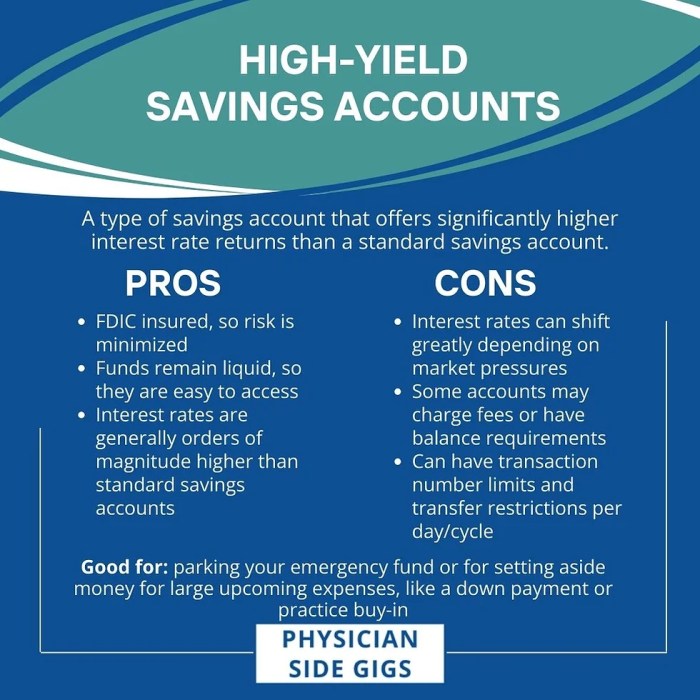

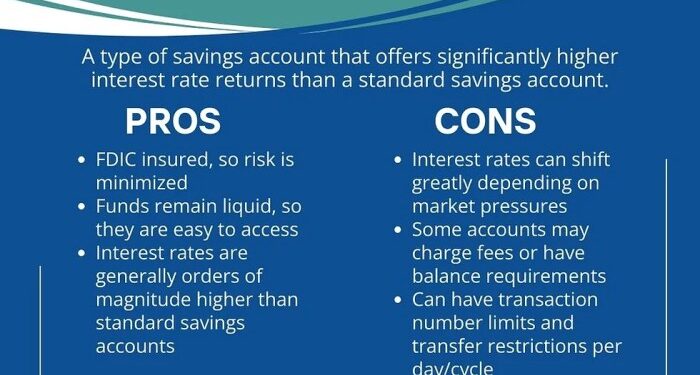

High-yield savings accounts are financial products offered by banks and credit unions that typically provide higher interest rates compared to traditional savings accounts. These accounts allow account holders to earn more on their savings over time.

Importance of APY Rates in High-Yield Savings Accounts

APY, or annual percentage yield, is a crucial factor to consider when choosing a high-yield savings account. It represents the total amount of interest you will earn on your savings in one year, taking into account compounding interest. A higher APY means you will earn more interest on your money over time, helping your savings grow faster.

Concept of FDIC Insurance and Its Significance for Account Holders

FDIC insurance, provided by the Federal Deposit Insurance Corporation, protects the money deposited in your high-yield savings account up to the legal limit in case the bank or credit union fails. This insurance gives peace of mind to account holders, knowing that their savings are safe and secure, even in uncertain financial times.

Factors to Consider When Choosing a High-Yield Savings Account

When selecting a high-yield savings account, there are several key factors to keep in mind to maximize your savings potential and ensure the safety of your funds.

Minimum Balance Requirements

- Some high-yield savings accounts have minimum balance requirements, which vary from account to account. These requirements can range from a few hundred dollars to several thousand.

- Compare and contrast the minimum balance requirements of different accounts to find one that aligns with your financial situation and goals.

- Be mindful of potential fees or penalties associated with falling below the minimum balance requirement, as these can eat into your savings over time.

Impact of APY Rates on Long-Term Savings Growth

- The Annual Percentage Yield (APY) of a high-yield savings account directly impacts the growth of your savings over time.

- A higher APY means your savings will grow at a faster rate, leading to greater returns on your investment.

- Consider the APY rates offered by different accounts and choose one that offers a competitive rate to maximize your long-term savings growth potential.

Role of FDIC Insurance in Ensuring Safety of Funds

- FDIC insurance protects your funds in a high-yield savings account up to $250,000 per depositor, per insured bank, in case of bank failure.

- Ensure that the high-yield savings account you choose is FDIC-insured to safeguard your savings against unforeseen circumstances.

- FDIC insurance provides peace of mind and security, allowing you to save with confidence knowing that your funds are protected.

Top High-Yield Savings Accounts in the United States (2026)

When looking for the best high-yield savings accounts in the United States for 2026, it's essential to consider the Annual Percentage Yield (APY) rates, minimum balance requirements, and whether the accounts are FDIC-insured. Here are some of the top high-yield savings accounts based on APY rates, along with an overview of their minimum balance rules and FDIC-insured options.

Ally Bank Online Savings Account

Ally Bank offers a competitive APY rate with no minimum balance requirement. This account is FDIC-insured up to the maximum allowed by law, providing peace of mind to depositors.

CIT Bank Savings Builder

CIT Bank's Savings Builder account offers a tiered APY rate, which incentivizes savers to maintain or increase their balance. While there is a minimum balance requirement, it is relatively low compared to other high-yield savings accounts. Deposits in this account are also FDIC-insured.

American Express High Yield Savings Account

American Express provides a high APY rate with no minimum balance requirement, making it accessible to a wide range of savers. This account is FDIC-insured, offering security for deposited funds.

Discover Online Savings Account

Discover's Online Savings Account features a competitive APY rate and no minimum balance requirement. Depositors can benefit from the peace of mind that comes with FDIC insurance on their savings.

Strategies for Maximizing Savings with High-Yield Accounts

When it comes to maximizing your savings with high-yield accounts, there are several strategies you can employ to make the most of your money.

Regularly Reviewing and Comparing APY Rates

One of the key strategies to maximize savings with high-yield accounts is to regularly review and compare APY rates offered by different financial institutions. By staying informed about the current rates, you can ensure that your money is earning the highest possible interest.

Leveraging Compound Interest

Another effective strategy is to take advantage of compound interest. This means that not only will you earn interest on your initial deposit, but you will also earn interest on the interest that has already been paid to you. By keeping your money in the account and allowing it to grow over time, you can significantly boost your savings through the power of compounding.

Conclusive Thoughts

In conclusion, navigating the realm of high-yield savings accounts in the United States (2026 APY Rates, Minimum Balance Rules & FDIC-Insured Options) offers a promising avenue for individuals seeking to maximize their savings potential while ensuring the safety of their funds.

Quick FAQs

What are the benefits of high-yield savings accounts?

High-yield savings accounts typically offer higher interest rates compared to traditional savings accounts, allowing account holders to grow their savings more quickly.

How do APY rates impact long-term savings growth?

Higher APY rates mean more interest earned on savings over time, leading to accelerated growth of funds deposited in the account.

What is the significance of FDIC insurance for account holders?

FDIC insurance protects funds in high-yield savings accounts up to a certain limit, providing peace of mind and security for account holders in case of bank failure.

How can individuals leverage high-yield savings accounts for their financial goals?

By regularly reviewing and comparing APY rates, individuals can ensure they are maximizing their savings potential and taking advantage of the best offers available.

![Top 10 SEO Companies In Houston [2025] | Aero Business Solutions](https://market.doclinks.org/wp-content/uploads/2025/12/SEO-Company-in-Houston-120x86.jpg)