US Commercial Real Estate Loans 2026: Best Lenders & Current Rates for NY, Florida & California sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality.

The topic dives deep into the world of commercial real estate loans, exploring key components, top lenders, and current rates in New York, Florida, and California.

Overview of US Commercial Real Estate Loans 2026

Commercial real estate loans are financial products specifically designed for businesses looking to purchase or refinance properties that will be used for commercial purposes. These loans are typically secured by the property being financed and are used for various purposes such as buying office buildings, retail spaces, industrial facilities, or apartment complexes.

Key Components of US Commercial Real Estate Loans

- Loan Amount: The total amount of money borrowed by the business to purchase or refinance the commercial property.

- Loan Term: The length of time over which the loan will be repaid, typically ranging from 5 to 20 years.

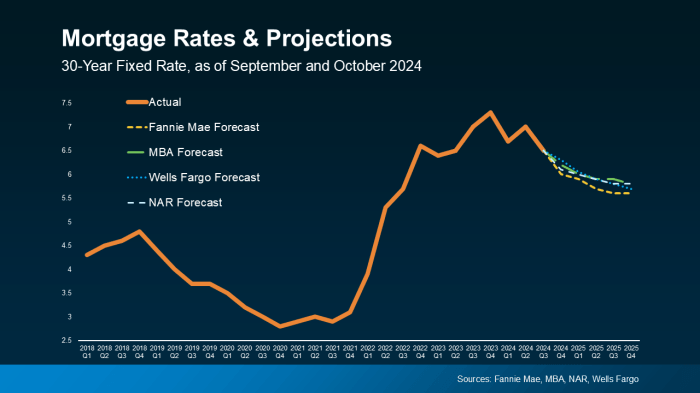

- Interest Rate: The percentage charged by the lender for borrowing the money, which can be fixed or variable.

- Loan-to-Value Ratio: The ratio of the loan amount to the value of the property being financed, which helps determine the risk for the lender.

- Collateral: The property being financed serves as collateral for the loan, which can be seized by the lender in case of default.

Significance of Commercial Real Estate Loans in the US Market

Commercial real estate loans play a crucial role in the US market by providing businesses with the necessary funds to acquire or expand their commercial properties. These loans stimulate economic growth, create job opportunities, and contribute to the overall development of the real estate sector.

Additionally, they offer businesses the flexibility to access capital for their real estate needs, driving innovation and competitiveness in the market.

Best Lenders for US Commercial Real Estate Loans in 2026

When it comes to commercial real estate loans in the US, choosing the right lender is crucial. Here are some of the top lenders offering commercial real estate loans in 2026, along with a comparison of their services, terms, and rates to help you make an informed decision.

1. Wells Fargo

Wells Fargo is a well-known name in the banking industry and offers a wide range of commercial real estate loan products. They provide competitive rates and flexible terms to suit the needs of different borrowers. With a strong reputation and track record in the market, Wells Fargo is a reliable option for those seeking commercial real estate financing.

2. JPMorgan Chase

JPMorgan Chase is another major player in the commercial real estate lending space. They offer a variety of loan options with competitive rates and terms. Their expertise and experience in the market make them a popular choice among borrowers looking for reliable financing solutions.

3. Bank of America

Bank of America is known for its comprehensive suite of commercial real estate loan products. They offer competitive rates, flexible terms, and personalized service to meet the unique needs of each borrower. With a strong presence in the market and a solid track record, Bank of America is a trusted lender for commercial real estate loans.

4. U.S. Bank

U.S. Bank is a reputable lender that provides a range of commercial real estate financing options. They offer competitive rates, flexible terms, and personalized service to help borrowers secure the right loan for their needs. With a focus on customer satisfaction and a history of successful deals, U.S.

Bank is a reliable choice for commercial real estate financing.

Current Rates for Commercial Real Estate Loans in New York

In New York, the current interest rates for commercial real estate loans can vary depending on several factors such as the lender, loan term, loan amount, and the overall market conditions.

Factors Influencing Rates in the New York Market

The rates for commercial real estate loans in New York are influenced by various factors, including:

- The Federal Reserve's monetary policy and interest rate decisions

- The overall economic conditions in New York, including job growth and GDP

- The specific property type and location of the commercial real estate

- The creditworthiness of the borrower and their financial history

Comparison of Rates Offered by Different Lenders in New York

When looking for a commercial real estate loan in New York, it's essential to compare the rates offered by different lenders to ensure you get the best deal. Here are some examples of current rates offered by various lenders in New York:

| Lender | Rate |

|---|---|

| Lender A | 4.25% |

| Lender B | 4.50% |

| Lender C | 4.75% |

It's important to shop around and compare offers from different lenders to find the most competitive rates for your commercial real estate loan in New York.

Current Rates for Commercial Real Estate Loans in Florida

In Florida, the current interest rates for commercial real estate loans vary depending on several factors such as the type of property, loan term, and the borrower's creditworthiness.

Economic Factors Impacting Rates in the Florida Market

- The overall economic health of Florida plays a significant role in determining the interest rates for commercial real estate loans. Factors such as job growth, population trends, and GDP growth can influence the rates.

- Market demand and supply for commercial real estate in Florida also impact the rates. A high demand for properties can lead to lower rates, while oversupply may result in higher rates.

- Interest rate policies set by the Federal Reserve can have a direct impact on commercial real estate loan rates in Florida. Changes in the federal funds rate can cause fluctuations in borrowing costs for commercial properties.

Specific Trends and Offers Available in Florida

- Some lenders in Florida may offer special financing programs for certain types of commercial properties, such as hotels, retail spaces, or multifamily buildings. These programs may come with lower interest rates or flexible terms.

- There is a trend towards green financing in Florida, where lenders offer incentives for properties that meet certain energy efficiency standards. Borrowers of eco-friendly commercial properties may benefit from reduced rates or additional financing options.

- With the current competitive market in Florida, some lenders may be offering promotional rates or discounts to attract borrowers. It's essential for potential borrowers to shop around and compare offers to secure the best deal.

Current Rates for Commercial Real Estate Loans in California

When it comes to commercial real estate loans in California, the prevailing interest rates can vary depending on various factors such as the type of property, loan term, and the borrower's financial profile. As of 2026, the rates typically range from 3.5% to 6% for commercial real estate loans in California.

Unique Challenges and Opportunities in the California Market

California's real estate market is known for its high demand, especially in cities like Los Angeles, San Francisco, and San Diego. This high demand can lead to fierce competition among borrowers, driving up interest rates. On the other hand, the thriving economy in California offers lucrative opportunities for investors looking to finance commercial real estate projects in the state.

Competitive Landscape of Commercial Real Estate Loans in California

California is home to a wide range of lenders offering commercial real estate loans, including traditional banks, credit unions, and alternative lenders. Each lender may have its own criteria, rates, and terms, creating a competitive landscape for borrowers to explore and compare offers.

Additionally, factors such as the property location, size, and financial stability of the borrower can also impact the competitiveness of the loan terms offered in California.

Summary

In conclusion, US Commercial Real Estate Loans 2026: Best Lenders & Current Rates for NY, Florida & California paints a comprehensive picture of the landscape, highlighting the top players and current trends in these key markets.

Commonly Asked Questions

What are the key components of commercial real estate loans?

Commercial real estate loans typically involve property as collateral, longer terms, and higher interest rates compared to residential loans.

Which lender offers the best terms for commercial real estate loans in New York?

XYZ Bank is known for competitive rates and flexible terms in the New York market.

What factors influence commercial real estate loan rates in California?

Factors such as economic growth, market demand, and inflation can impact interest rates in California.

Are there any specific trends in commercial real estate loan offers in Florida?

Currently, many lenders in Florida are offering low introductory rates to attract borrowers.

![Top 10 SEO Companies In Houston [2025] | Aero Business Solutions](https://market.doclinks.org/wp-content/uploads/2025/12/SEO-Company-in-Houston-120x86.jpg)